What is Accounting? Simply Explained by HTBOOK

Accounting is the strategy of tracking, recording and storing financial transactions. It helps in understanding how money is being used and assigned in an organization. What is accounting? It is a method that allow businesses to measure their financial activity and performance. Through accounting, one can prepare key reports like income statements, balance sheets and cash flow records. This system is the foundation for responsible financial decision making and is used across all industries and sectors.

Accounting is far more than just number-crunching. it is the essential strategic framework for financial clarity and intelligent decision-making in any organization.

At its core, accounting is the systematic process of

recording, summarizing, analyzing, and reporting financial transactions.

Think of it as the language of business a universal method of communicating a

company's financial health to managers, investors, regulators, and other

stakeholders.

When we ask, what is accounting? the answer lies in its role as the foundation for credibility. It provides a clear, accurate picture of how money enters a business (revenue), how it leaves (expenses), and where it is stored (assets and liabilities). This system transforms raw financial data into actionable insights, answering critical questions about profitability, stability, and growth potential.

What is difference between accounting and finance

What is the differentiation between accounting and finance? Accounting is built on collecting and reporting financial data. Finance, on the reverse hand, uses this data to manage and plan for the future. What is accounting and finance together? They are strongly related. While accounting provide the foundation, finance builds on it to develop strategies for growth and stability. Both are critical for maintaining strong financial structure in business. Accounting and finance work together to track performance and avoid complications.

The Critical Role of Accounting in Business

In a business, accounting is about maintaining an accurate record of all money related activities. It shows how a company earns and spends. What is accounting in business? It gives owner and manager the confidence they need to make sound choices. It also helps in calculating profits and understanding expenses. This clarity is important to maintain smooth operations. Without reliable accounting, even the best business ideas can become stale due to financial mismanagement.

- Make informed decisions with confidence, backed by data.

- Track profitability and cash flow precisely.

- Ensure regulatory and tax compliance.

- Secure funding by providing transparent records to banks and investors.

- Identify trends and inefficiencies to optimize operations.

Key Types of Accounting

Different business needs are met by specialized branches of

accounting:

- Financial Accounting: Focuses on external reporting for stakeholders (investors, regulators) following strict standards (GAAP/IFRS).

- Management Accounting: Focuses on internal reporting to aid in planning, budgeting, and decision-making by managers.

- Tax Accounting: Specializes in preparing tax returns and planning for tax efficiency.

- Cost Accounting: Analyzes production costs to help control expenses and improve profitability.

Accounting Standards and Methods

- Accounting Standards (GAAP/IFRS): These are the rulebooks established principles and guidelines that ensure consistency, reliability, and comparability in financial reporting across companies and borders. Adhering to these standards builds trust and credibility.

- Accrual Accounting vs. Cash Accounting: This is a fundamental choice in accounting basis.

- Accrual Accounting used by most businesses records revenue when earned and expenses when incurred, regardless of cash movement. This gives a truer picture of financial performance within a period.

- Cash Accounting records transactions only when cash is received or paid. It's simpler but can be misleading for understanding longer-term profitability.

Understanding Basics Debits, Credits, and Beyond

What is basic accounting? It starts with

foundational concepts:

- The Double-Entry System: Every transaction affects at least two accounts, maintaining the equation: Assets = Liabilities + Equity.

- Debits and Credits: Debits (Dr) increase asset or expense accounts, while Credits (Cr) increase liability, equity, or revenue accounts.

- Core Financial Statements: The Balance Sheet, Income Statement, and Cash Flow Statement.

Understanding these basics is empowering, not just for business, but for managing personal finances with greater control.

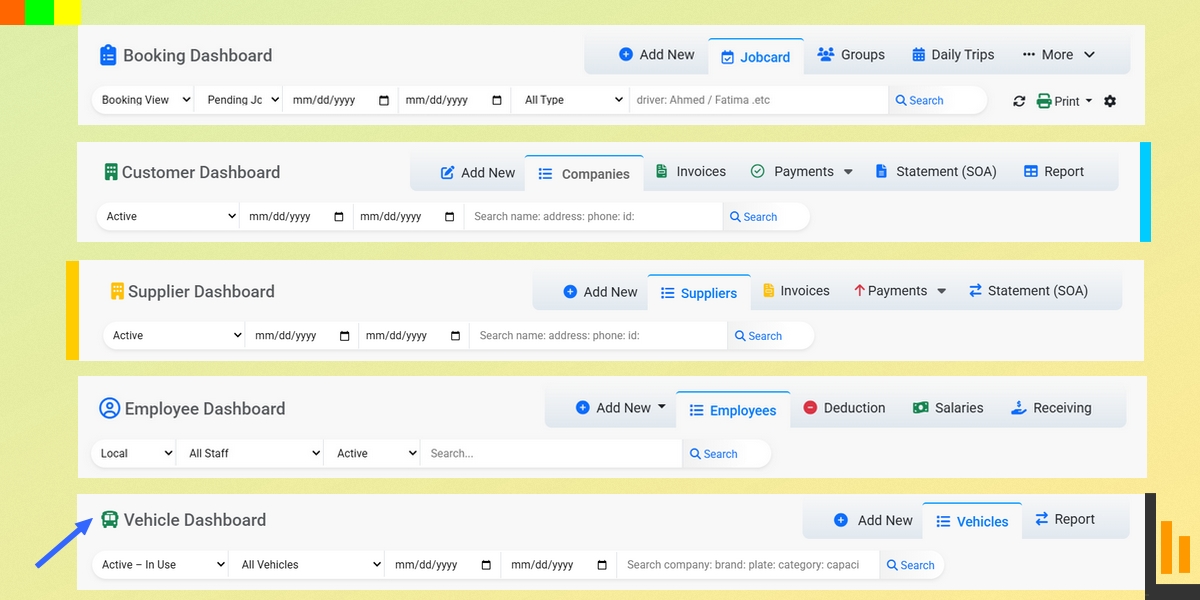

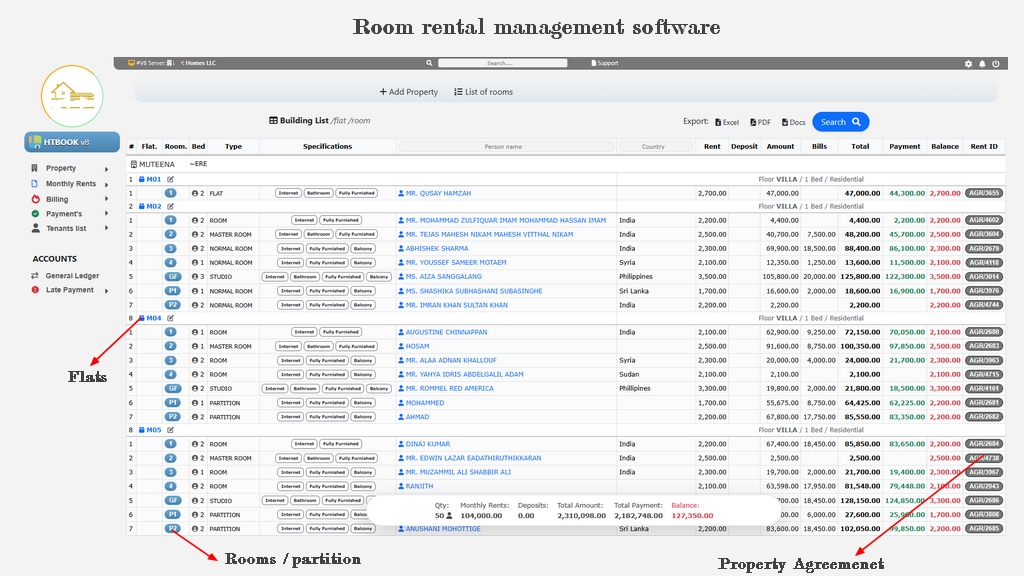

The Modern Solution: Accounting Software

What is accounting software? It is the digital

evolution of the ledger, automating and streamlining every financial task.

Modern software eliminates manual errors, saves time, and provides real-time

insights through features like:

- Automated invoicing and billing

- Expense tracking and reconciliation

- Digital accounting books (general ledger, journals)

- Instant financial reporting and dashboards

- Secure cloud-based data storage