Free Online VAT Calculator for UAE (5%) & Saudi Arabia (15%)

Instant, accurate calculations for businesses in Dubai, Abu Dhabi, Riyadh, and across the GCC.

Easily calculate VAT for exclusive or inclusive prices. Enter your amount and VAT rate to get instant results.

This easy VAT calculator helps you find inclusive or exclusive VAT amounts in seconds. It’s perfect for businesses, freelancers, and accountants who need accurate tax calculations.

Learn how VAT works, who must register, and how to manage VAT records correctly. Stay compliant and simplify your billing process with this free online VAT calculator designed for GCC businesses.

How to Use the VAT Calculator for Dubai:

- Enter the Net Price or product value.

- Add the VAT Rate (%). Default is 5% in the UAE.

- Select:

- Exclusive of VAT : Adds VAT on top of your price.

- Inclusive of VAT : Finds VAT already included in your total price.

- Click Calculate to get results instantly.

How to Use the VAT Calculator for Saudi Arabia (KSA):

- Enter the Net Price or product value.

- Add the VAT Rate (%). 15% Value for VAT in KSA.

- Select:

- Exclusive of VAT : Adds VAT on top of your price.

- Inclusive of VAT : Finds VAT already included in your total price.

- Click Calculate to get results instantly

VAT Calculation Formulas

- Exclusive of VAT:

- VAT = (Price × VAT Rate) ÷ 100

- Total = Price + VAT

- Inclusive of VAT:

- VAT = (Total × VAT Rate) ÷ (100 + VAT Rate)

- Taxable Value = (Total × 100) ÷ (100 + VAT Rate)

Simplify your financial operations in the Gulf. The introduction of VAT in the UAE and KSA has made precise tax calculation essential for every invoice, receipt, and return. Avoid costly errors and ensure full compliance with the regulations of the UAE Federal Tax Authority (FTA) and Saudi ZATCA. Our expert-developed VAT calculator provides instant, reliable calculations, giving you peace of mind and freeing you to focus on growing your business in Dubai, Abu Dhabi, or Saudi Arabia.

Understanding VAT Calculations for UAE and KSA

| Scenario | Country | Formula | Example (Amount: 100) |

| Adding VAT (Net → Gross) | UAE | Total = Net Price × 1.05 | 100 × 1.05 = AED 105 |

| Adding VAT (Net → Gross) | KSA | Total = Net Price × 1.15 | 100 × 1.15 = SAR 115 |

| Subtracting VAT (Gross → Net) | UAE | Net = Gross Price / 1.05 | 105 / 1.05 = AED 100 |

| Subtracting VAT (Gross → Net) | KSA | Net = Gross Price / 1.15 | 115 / 1.15 = SAR 100 |

VAT Registration Thresholds: UAE vs. KSA

| Criteria | United Arab Emirates (UAE) | Kingdom of Saudi Arabia (KSA) |

| Mandatory Registration | Annual taxable supplies > AED 375,000 | Annual taxable supplies > SAR 375,000 |

| Voluntary Registration | Annual supplies > AED 187,500 OR anticipated expenses > AED 187,500 | Annual supplies > SAR 187 |

| Standard VAT Rate | 5% | 15% |

VAT Categories for UAE:

The standard rate for VAT in UAE is 5%, but there are some areas where the VAT is Exempted and in some areas are considered zero.

VAT Rate in UAE

Area

Zero-Rated

(0% VAT)

Exports outside GCC,

international transport, certain education/healthcare services, first sale of

new residential properties, investment precious metals.

Exempt

Supplies

Some financial services,

residential rental, bare land, local passenger transport.

Standard

Rated (5%)

Most goods and services.

VAT Categories for KSA:

VAT Rate in UAE | Area |

Zero-Rated (0% VAT) | Exports outside GCC,

international transport, certain education/healthcare services, first sale of

new residential properties, investment precious metals. |

Exempt Supplies | Some financial services,

residential rental, bare land, local passenger transport. |

Standard Rated (5%) | Most goods and services. |

VAT Rate in KSA Areas Zero-Rated (0% VAT) Exports outside GCC, international transport, certain medicines/medical equipment. Exempt Supplies Some financial services, residential rental. Standard Rated (15%) Most goods and services. Key Concept for Input VAT, Output VAT, and Net Payable:

- Input

VAT: VAT you pay on business purchases.

- Output

VAT: VAT you charge on your sales.

- Net

VAT Payable/Refund: Output VAT - Input VAT. This is what you pay

to (or reclaim from) the tax authority (FTA or ZATCA).

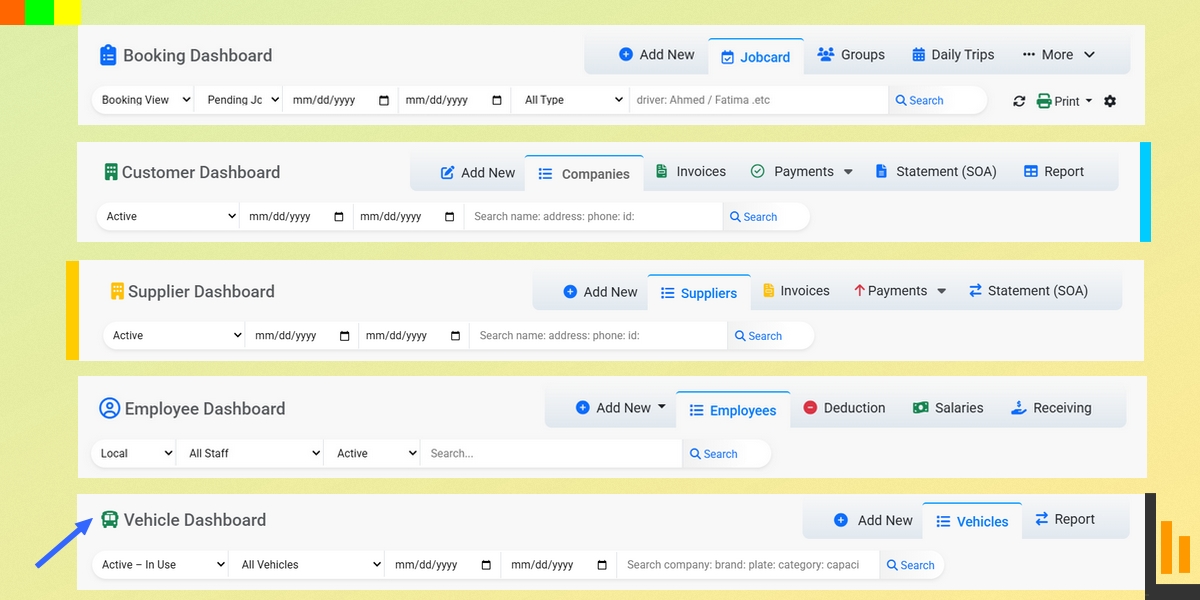

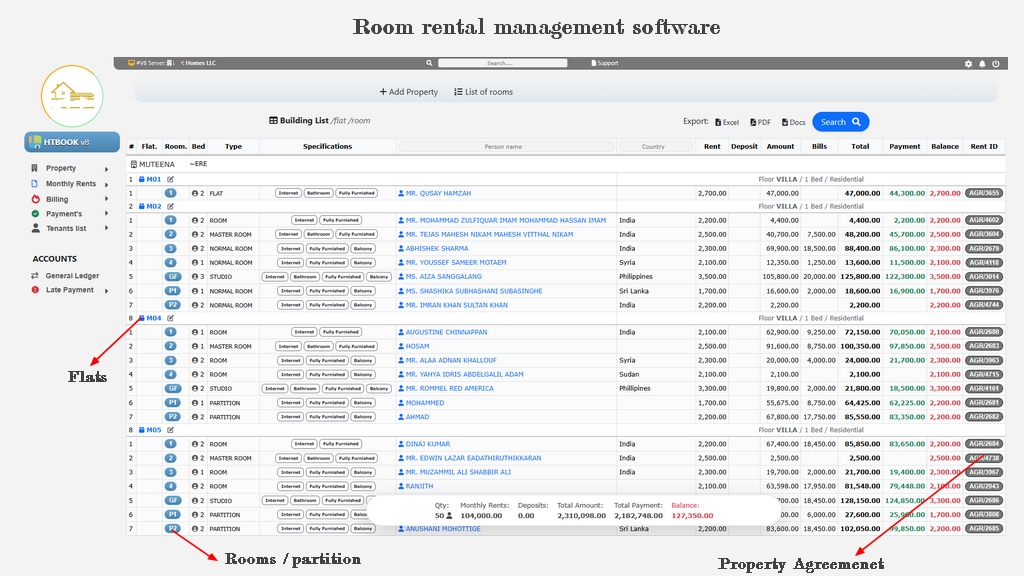

Automate Your VAT with HTBOOK

- Input

VAT: VAT you pay on business purchases.

Try HTBOOK VAT software to automate your VAT billing, invoice creation, and tax compliance in UAE, Saudi Arabia, Oman, and Bahrain. HTBOOK saves time and ensures accurate VAT reports for your business.

Frequently Asked Questions (FAQ's):

(Q): Is VAT the same in Dubai and Abu Dhabi?

Ans: Yes, both follow the UAE federal VAT law at 5%.

Q: Can I use this calculator for both UAE and Saudi Arabia?

Ans: Yes! Simply toggle between the 5% (UAE) and 15% (KSA) rates.

Q: What if my turnover is below the threshold?

Ans: Registration is optional if you're between the voluntary threshold (AED/SAR 187,500) and mandatory threshold (AED/SAR 375,000), but you cannot charge VAT if you are not registered.

Q: How do I register for VAT?

Ans: Register online through the official portals of the UAE Federal Tax Authority (FTA) or Saudi ZATCA by submitting your business documents and application form.

Q: What are the penalties for late VAT filing?

Ans: Penalties include fixed fines (e.g., AED/SAR 1,000+ per late return) plus monthly percentage-based fines on any unpaid tax, which can accumulate significantly.