VAT Exclusive vs. Inclusive and Tax-Exempt Transactions

What is VAT in Business

VAT or Value Added Tax, is type of third party tax that applies at each stage of production or distribution. This tax is usually charged when goods or services are sold. For any business, understanding VAT is vital. It changes how products are priced and how the current invoice is calculated. Whether the tax is included in the price or added on top of it changes the total cost to the customer. This also impacts how businesses record revenue and expenses.

What is VAT Exclusive

VAT exclusive means the price of a product or service does not include VAT. The tax is added after the base price is set. When a business issues a bill marked as VAT exclusive, it must apply the VAT percentage on top of the quoted rate. For example, if the basic price of a service is 1,000 and VAT is 5%, the customer will pay 1,050. This method is often used in B2B dealings where both parties understand and track tax separately.

What is VAT Inclusive

VAT inclusive refers to prices that already have VAT included. This means the listed price is the total amount payable, with tax embedded in the final figure. If the marked price of a product is 1,050 and VAT is 5%, then the base price before tax is 1,000. This approach is common in retail and service sectors where customers expect a single price and do not calculate taxes separately. It makes transactions more straightforward for everyday buyers.

Difference between VAT Inclusive and Exclusive

The difference lies in how the tax is shown and calculated. In VAT exclusive pricing, tax is calculated separately and added to the total. In VAT inclusive pricing, tax is already part of the final price. This affects how businesses handle invoicing and record income. For customers, across the board pricing provides clarity upfront, while exclusive pricing may appear cheaper but adds tax later. The selection of one over the other depend on the nature of the business and customer preference.

Examples of VAT Exclusive and Inclusive

A VAT exclusive bill will show the product price as 2,000 and VAT as 100, bring forward the total to 2,100. On the other hand, a VAT inclusive bill would clearly list the total as 2,100, with a note that VAT is already applied. In this case, the business must calculate the portion of VAT from the total. Both methods reach the same financial result but differ in presentation and calculation. These formats are used depending on the industry and tax reporting requirements.

What Are Tax-Exempt Transactions

Tax exempt transactions are sales that are not subject to VAT. This means the customer pays only the base price, and no VAT is charged or reported. Certain goods and services, such as medical supplies, educational services, and exports, are often exempt from VAT based on national tax policies. These rules vary by country and are defined by tax authorities. Businesses must ensure that exempt items are correctly marked and documented to avoid issues during audits.

How VAT Affects Tax-Exempt Transactions

Although tax is not applied on exempt transactions, they still influence VAT records. Businesses must keep detailed logs of tax-exempt sales and provide proper justification. Even though no VAT is collected, the company may still have to report such transactions in their VAT filings. If an organization handles both taxable and exempt goods, its accounting system must clearly separate these records. This ensures transparency and compliance with tax laws.

Specific Uses of VAT Inclusive, Exclusive and Tax Exempt Models

VAT inclusive pricing is generally used in consumer facing sectors like supermarkets or salons. VAT exclusive pricing is standard in industries like construction, IT services and wholesale trading, where tax breakdown is needed for records. Tax-exempt transactions are common in sectors like health care, education and export businesses. Each model serves a different function and helps businesses structure their pricing and tax collection based on their market.

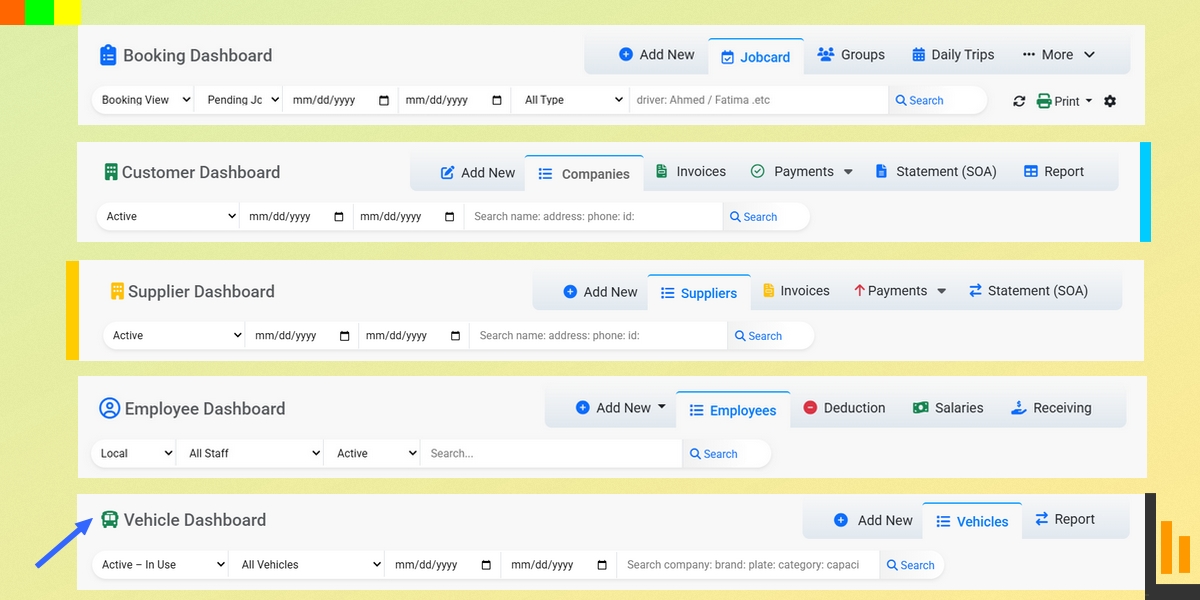

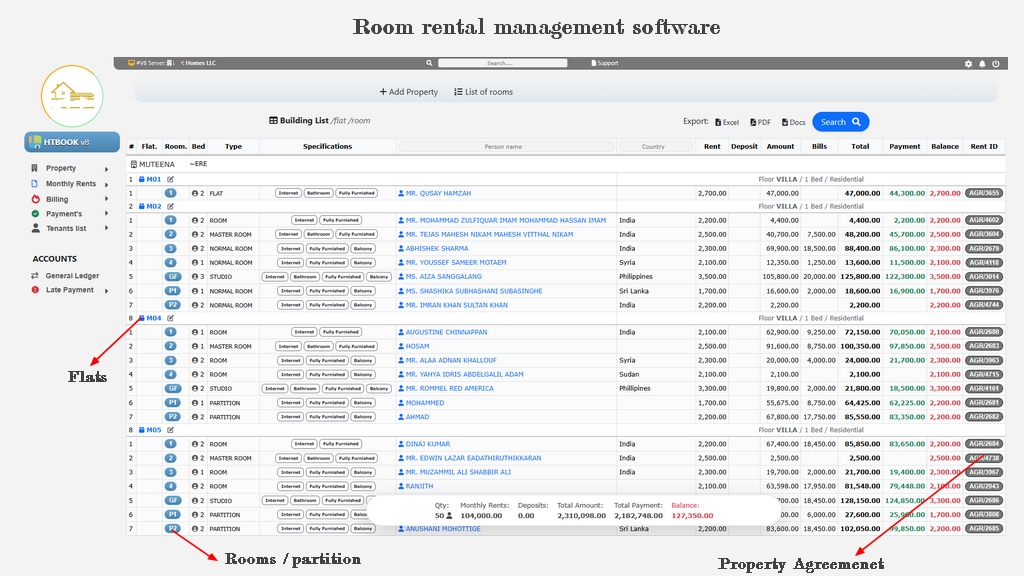

VAT Software and Major Manufacturers

Modern accounting relies on digital tools to handle VAT calculations. VAT software automates tax rate application, invoice generation, and compliance reports. Several companies offer such solutions, including HTBOOK, QuickBooks, Tally, Zoho Books, and SAP. These platforms simplify tasks that were once manual and reduce errors in financial reporting. They help businesses stay compliant with country-specific tax regulations and manage both taxable and tax-exempt records efficiently.